Salary calculator with overtime and taxes

Exempt means the employee does not receive overtime pay. Paying employees can get complicated.

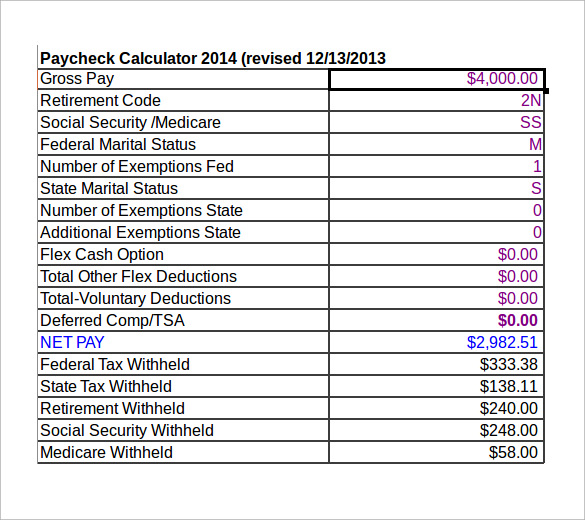

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

This would be difficult to compute and is beyond the scope of this app.

. The calculator includes rates for regular time and overtime. - Federal taxes - State taxes - Medicare. They must be compensated at least 15 times the employees regular hourly rate.

The rule keeps employers from rounding down extra hours. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek.

The hourly rate to annual salary calculator can help them to figure out how much they really earn in a year. But if you render overtime for 58 minutes your employer must round it up to 60 minutes. Using our California Salary Tax Calculator.

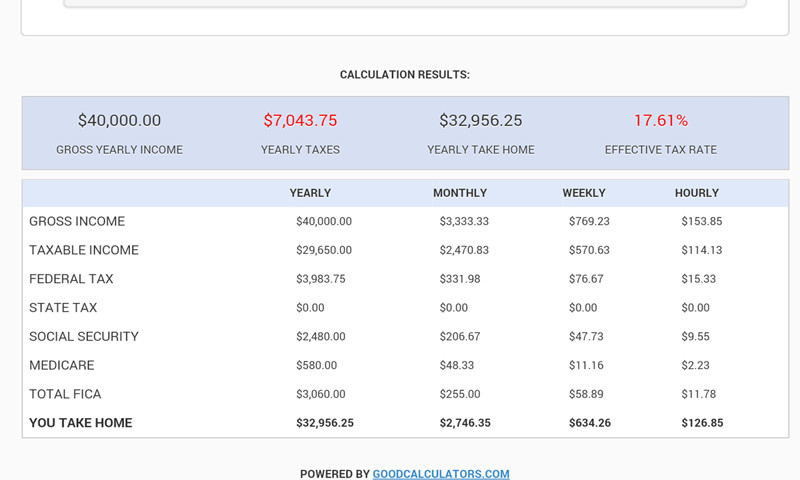

More career advancement opportunities. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. After a few seconds you will be provided with a full breakdown of the tax you are paying.

What to know about California paychecks and taxes. Its not as simple as taking their annual salary and dividing it by a set number of pay periodsyou have to withhold the appropriate amount of taxes from employee paychecks pay your own payroll taxes and follow numerous paycheck rules. To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

If you worked overtime for 53 minutes your employer can round it down to 50 minutes. If you have a high salary but also very high outgoings it could impact how much you can borrow. The amount that appears in box 3 of your Form W-2 should not be more than 142800 in the 2021 tax year for this reason.

The above calculator is our quick easy-to-use simplified calculator which converts wages from one period to another but it doesnt account for more advanced computations including variables like. Some autonomy over your schedule. For example a salary for a marketing manager might be 75000 per year.

The Employer Car Salary Sacrifice calculator estimates all of the items in the Employee calculator plus. Of course Utah taxpayers also have to pay federal income taxes. Calculate your value based on your work experience and skill set.

It can also be used to help fill steps 3 and 4 of a W-4 form. Overtime wages retirement contributions and state and federal taxes including unemployment insurance FICA contributions. Inform your career path by finding your customized salary.

To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option. To keep the calculations simple overtime rates are based on a normal week of 375 hours. You can budget your salary according to tax rates and excise tax on commodities.

Cost of Living Calculator. The salary numbers on this page. If you have an employee-employer tax filing scheme you can check if.

Find out the benefit of that overtime. All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. Overview of Utah Taxes.

Holiday pay for example time and a half Ability to dedicate time to other interests. The difference in tax NIC and pension scheme contributions between cash pay and Car Salary Sacrifice. Find out what you should earn with a customized salary estimate and negotiate pay with confidence.

This calculator is intended for use by US. As an employer use this calculator to help determine the annual cost of raising an hourly rate or how hourly workers overhead business expenses on an annual basis. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

The hourly to salary calculator converts an hourly wage to annual salary or the other way around. Make the most out of your salary when you put in the extra work. Hourly to Salary Calculator for Employers.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Remember that a full salary with benefits can include health insurance and retirement benefits that add more value to your total annual salary compared to similar hourly rates. It does calculate net pay.

Any hours beyond the standard 40 are considered overtime. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. The net pay and net delivered value of the employees pay packet before and after Car Salary Sacrifice.

If you are using an online tax calculator you can also have the option to avail their service of filing taxes for you. Use this calculator to easily convert a salary to an hourly rate and the corresponding daily wage monthly or weekly salaryUse it to estimate what hourly rate you need to get to a given salary yearly monthly weekly etc in other words calculate how much is X a year as a per hour wage. No cities in the Beehive State have local income taxes.

Most nonexempt employees in California have a legal right to receive overtime wages when they work long hours1 The amount of overtime depends on the length of the employees shift and the number of days. If that salary is paid monthly on the 1st of each month you can calculate the monthly salary by dividing the total salary by the number of payments made in. Explore the cost of living and working in various locations.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Then enter the employees gross salary amount. Paid time off and sick days.

There are two options in case you have two different overtime rates. It increases to 147000 in 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary. Eligibility for more better benefits.

Utah has a very simple income tax system with just a single flat rate. The unadjusted results ignore the holidays and paid vacation days. How do I calculate my take-home pay after income taxes.

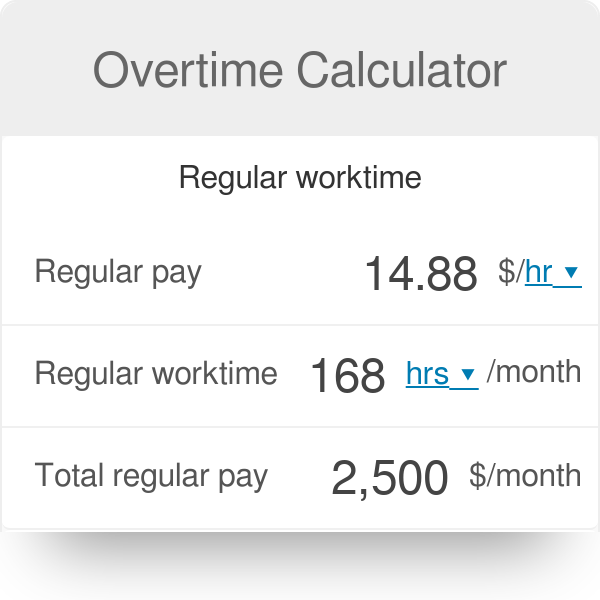

Enter the number of hours and the rate at which you will get paid. Usable income 70k this will be the figure thats multiplied to calculate your loan You can use our debt-to-income calculator below to work out how your outgoings could impact your maximum. The salary calculator will also give you information on your daily weekly and monthly earnings.

Salary to Hourly Calculator. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. For example for 5 hours a month at time and a half enter 5 15.

This tax has a maximum capthe wage baseof 142800 in earnings for the 2021 tax year. Net pay would deduct taxes Social Security Medicare local state and federal taxes health insurance and retirement savings 401K and IRA from your paycheck. You may also want to factor in overtime pay and the effects of any.

This breakdown will include how much income tax you are paying state taxes. Heres what you need to know about California.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Tax Calculator For Paycheck Store 52 Off Www Wtashows Com

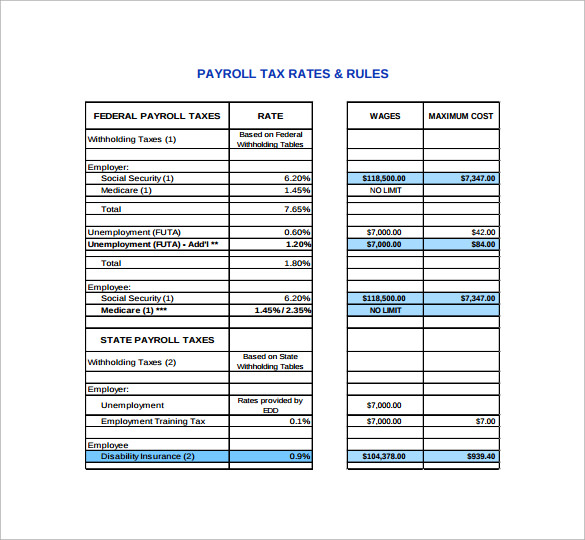

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Paycheck Calculator Take Home Pay Calculator

Pay Calculator With Taxes Deals 50 Off Www Wtashows Com

Overtime Calculator

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Tax Payroll Calculator Outlet 54 Off Www Wtashows Com

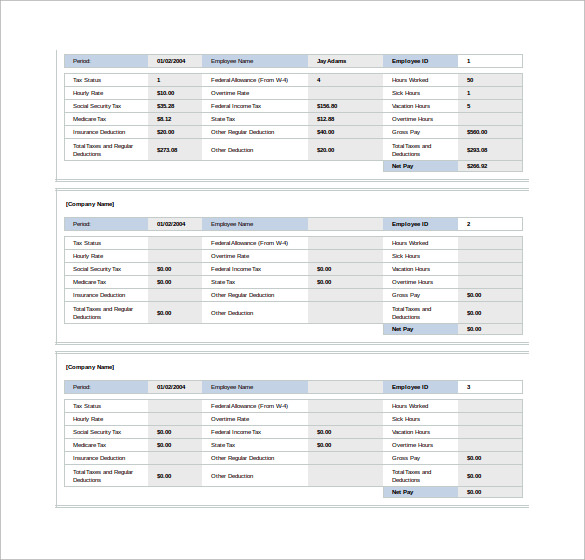

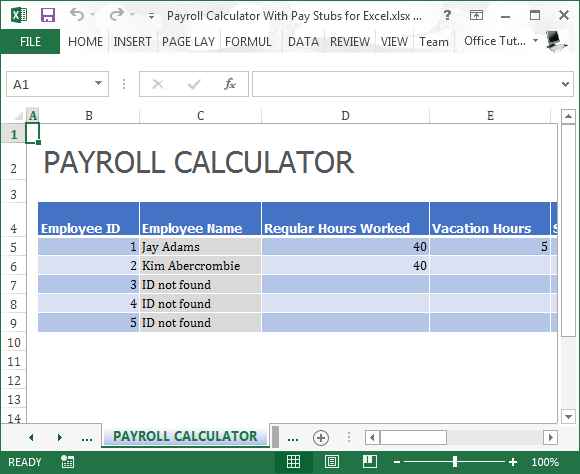

Payroll Calculator With Pay Stubs For Excel

Federal Income Tax Fit Payroll Tax Calculation Youtube

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Salary Pay Tax Calculator Suburbsfinder

Salary Calculator With Taxes Best Sale 55 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Salary Calculator With Taxes Best Sale 55 Off Www Wtashows Com

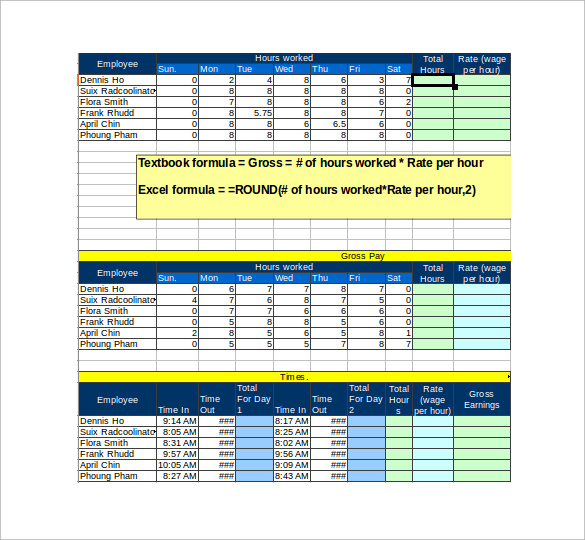

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator